Dilico Anishinabek Family Care: collecting and applying strengths-based data on health, mental health, and child and family services

This analysis was produced by IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis do not necessarily reflect the views of the AFN.

"Are these kids just a figment of their imagination?” A case study on Animikii Ozoson Child & Family Services

This analysis was produced by IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis do not necessarily reflect the views of the AFN.

Challenges of Implementation and Major Policy Change: Indigenous Affairs in Australia

This analysis was produced at the request of IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis of the independent authors do not necessarily reflect the views of the AFN or IFSD.

Why Measuring Matters

This research was produced at the request of IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis of the independent authors do not necessarily reflect the views of the AFN or IFSD.

Intergenerational Trauma To Intergenerational Transmission

This first person narrative was produced at the request of IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis of the independent authors do not necessarily reflect the views of the AFN or IFSD.

Consumer price inflation and funding for First Nations

This note briefly describes what inflation is and how it is measured. It discusses the recent sharp increases in inflation in Canada, which has brought hardship to many Canadians, particularly First Nations.

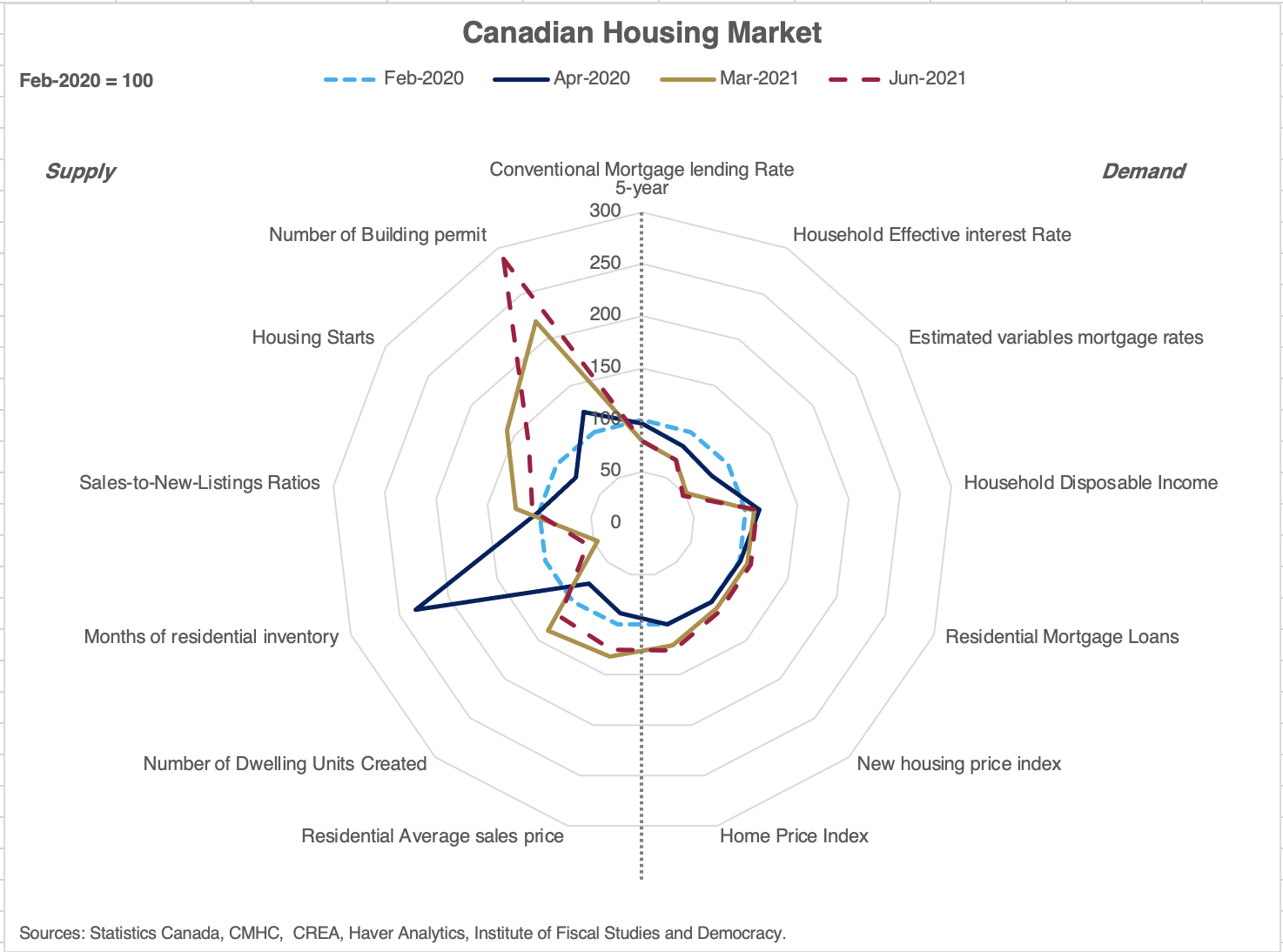

Canadian Housing Market Challenged by Pandemic Jolts: A year-long indicator analysis

Assessing how the Canadian dream of homeownership was affected through this challenging period can provide helpful context for understanding the impacts on this industry and help guide new policies to calm the market. In this note, we selected a number of metrics for both supply and demand in the housing market.

Testing platforms through fiscal credibility: A summary of the 2021 platforms of the Liberal Party of Canada (LPC), Conservative Party of Canada (CPC), and New Democratic Party (NDP)

Using the framework, the platforms of the Liberal Party of Canada (LPC), the Conservative Party of Canada (CPC), and the New Democratic Party (NDP) were assessed ahead of Election Day 2021. IFSD assessed the parties’ platforms in the order in which they were released and published its findings (LPC, CPC, NDP

IFSD Fiscal Credibility Assessment New Democratic Party Platform 2021

IFSD finds that the New Democratic Party (NDP) Platform 2021 merits a rating of ‘pass,’ with ratings of ‘good’ for realistic economic and fiscal assumptions, a ‘pass’ for responsible fiscal management, and a’ fail’ on transparency.

IFSD Fiscal Credibility Assessment Conservative Party of Canada Platform 2021

IFSD finds The Conservative Party of Canada’s Platform with ratings of ‘good’ across two of the three assessment principles (realistic economic and fiscal assumptions, responsible fiscal management, and transparency).

IFSD Fiscal Credibility Assessment Liberal Party of Canada Platform 2021

IFSD finds that the Liberal Party Platform 2021 merits an overall rating of ‘good,’ with ratings of ‘good’ across the three assessment principles (realistic economic and fiscal assumptions, responsible fiscal management, and transparency).

Fiscal Sustainability under Alternative Scenarios

Despite the unprecedented increase in COVID-related government spending, current government finances are estimated to be sustainable in the long run. What happens if there is a moderate increase in interest rates or the government introduces a new program that rises spending significantly on a permanent basis?

Not the most alluring of tasks: reforming Canada’s fiscal practices, lessons from the Open Budget Survey (OBS) 2019

Budgeting is about more than dollars, but about trade-offs. How money is allocated, the value citizens get for the spending, and the long-term sustainability of public finances are crucial considerations. How does Canada’s system compare to those of its international peers? The International Budget Partnership’s Open Budget Survey offers some perspective on transparency, legislative, and audit oversight.

The Election and Public Finances

In the 2019 federal election, between the two front running parties, there seems to be battle lines drawn between the party of fiscal responsibility and the party of policy leadership. We are led to believe that these choices are mutually exclusive. Both the Conservatives and the Liberals are to blame for this confusion. The blame can be shared by the rest of us who have failed to explain the nuances of a well performing government budgetary system. We have attempted to assess the party platforms for fiscal credibility but feel that we should now put these in some context.

IFSD Fiscal Credibility Assessment: New Democratic Party (NDP) Platform 2019 Costing

IFSD finds that that the NDP Party Platform Costing merits an overall ‘pass’ rating including a ‘pass’ rating on the principles related to realistic economic and fiscal assumptions and responsible fiscal management; and a ‘fail’ rating with respect to transparency.

IFSD Fiscal Credibility Assessment: Conservative Party of Canada Platform 2019 Costing

IFSD finds that that the Conservative Party Platform Costing merits an overall ‘pass’ rating, including a ‘pass’ rating on the principles related to realistic economic and fiscal assumptions and transparency; and a ‘good’ rating with respect to responsible fiscal management.

IFSD Fiscal Credibility Assessment: Bloc Québécois Platform 2019 Costing

IFSD finds that the Bloc Québécois’ Platform 2019 Costing fails overall with respect to realistic economic and fiscal assumptions, responsible fiscal management and transparency.

IFSD Fiscal Credibility Re-Assessment : Green Party of Canada Platform 2019 Costing

The Green Party of Canada released a revised Platform 2019 Costing document on October 2, 2019. This document followed the initial release of a costing document on September 25, 2019 and a policy commitments document (Election Platform 2019 - Honest, Caring, Ethical Leadership) on September 15, 2019.

IFSD Fiscal Credibility Assessment: Liberal Party of Canada Platform 2019 Costing

The Liberal Party Platform Costing merits an overall ‘good’ rating with a ‘pass’ on realistic economic and fiscal assumptions and a rating of ‘good’ with respect to the principles of responsible fiscal management and transparency.

IFSD Fiscal Credibility Assessment : Green Party of Canada Platform 2019 Costing

The Green Party of Canada’s Platform Costing presents ambitious policy commitments without requisite economic and fiscal planning and transparency.

.png)