by Randall Bartlett

One of the more interesting unknowns in economics today is why economic activity has taken off, particularly in advance economies, but inflation in those countries has remained weak. This blogpost will examine why the strong-growth-weak-inflation dynamic has been observed in Canada, and why this phenomenon is about to come to an end. It concludes that wage growth has lagged advances in the Canadian economy and labour market, and that impending wage growth due to a tight labour market will drive higher core Consumer Price Index (CPI) inflation. But, as the Bank of Canada has telegraphed that it plans to take its time in raising interest rates, it could very quickly find itself behind the curve.

It all starts with the output gap

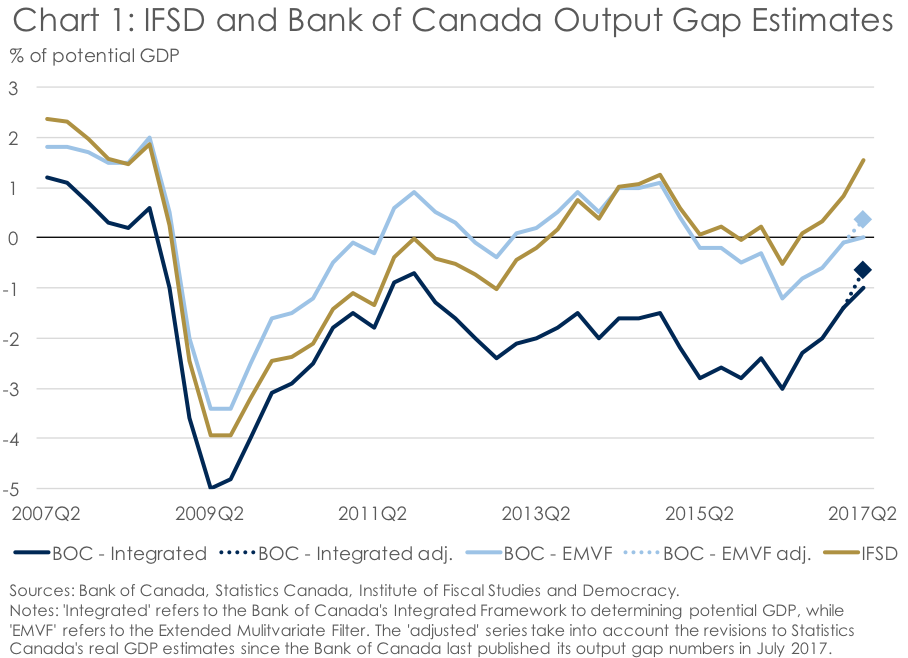

The output gap is the percent difference between the level of actual real Gross Domestic Product (GDP) and potential GDP – the unobserved level of trend output when the impact of the business cycle has been removed. There are a multitude of approaches to determining potential GDP. The Bank of Canada uses two of these: the Integrated Framework and the Extended Multivariate Filter. The IFSD’s approach to determining potential GDP is very similar to the Bank of Canada’s Integrated Framework approach, which relies heavily on a detailed demographic forecast.

The output gap matters as it indicates whether an economy is ‘running hot’ – the level of actual real GDP is above the level of potential GDP – or whether it has ‘room to run’ – the level of actual real GDP is below the level of potential GDP. Typically, when the economic output is above its potential, this is soon followed by increased labour market strength. As the labour market tightens, wage growth generally accelerates, which ultimately contributes to stronger core and total CPI inflation. And, as total CPI inflation relative to the Bank of Canada’s 2% inflation target is the guide for monetary policy, higher CPI inflation ultimately means higher interest rates to offset it. The opposite chain of economic causality takes place when the output gap is negative.

Of course, the feedback from changes in interest rates to inflation happens with a lag. Changes in interest rates impact the economic decisions that people and businesses make, with higher interest rates leading consumers to spend less and business to hold back investment. The resulting reduced economic activity leads to lower hiring and, hence, wage growth. Ultimately, lower demand and slower wage gains feed into weaker CPI inflation. Again, the opposite chain of events takes place when interest rates are cut.

Current state of the Canadian economy and labour market

The Canadian economy has been performing very well of the past year. On a quarterly basis, real GDP growth has averaged 3.7% at annualized rates, well above the average IFSD-estimated potential GDP growth of 1.6% annualized over that same period. As a result, the IFSD estimated in its September 2017 Canadian Economic Forecast that the output gap has gone from -0.5% in 2016Q2 to +1.5% in 2017Q2 (Chart 1). This is notably higher than the Bank of Canada’s estimate of the 2017Q2 output gap in its July 2017 Monetary Policy Report (MPR), which ranged from -1% to 0%. Even after adjusting for updated real GDP numbers published by Statistics Canada at the end of August 2017, the average of the Bank of Canada’s output gap measures in the second quarter of 2017 only rose to about -0.1%. But, while well below the IFSD’s output gap estimate, it does suggest that the Bank of Canada is acknowledging that there is currently no remaining slack in the Canadian economy. Hence, the Bank of Canada was justified in raising interest rates in both July and September 2017.

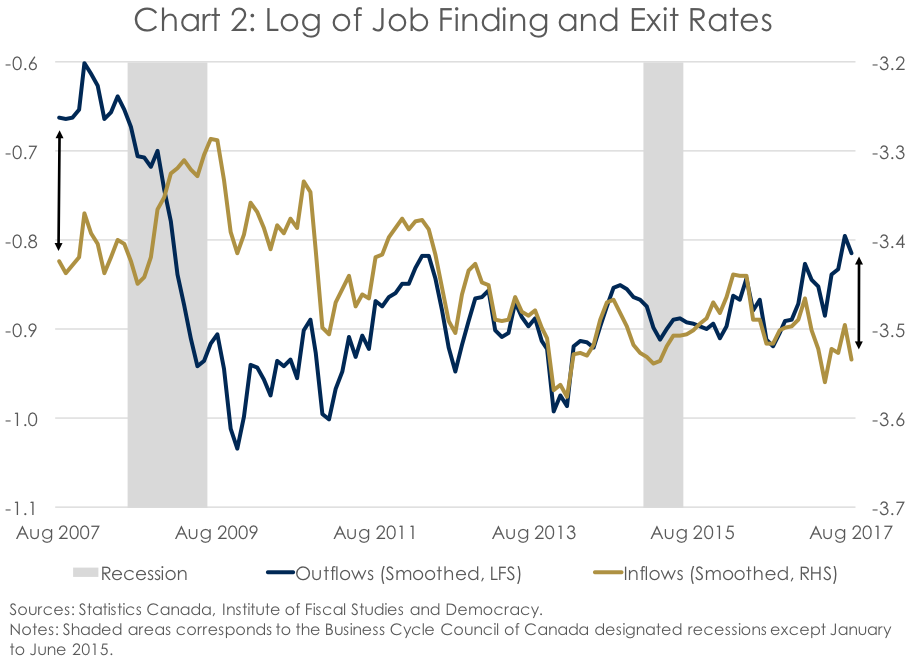

So, if the output gap is closed or better, what does this mean for labour markets? Well, as consumers continue spending and businesses ramp up investment, demand for labour increases, ultimately causing any excess supply to shrink at existing wages. If demand continues to outpace supply, wage gains begin to accelerate, attracting people that were not previously in the labour market to take positions that were undesirable at lower wage rates. And this uptick in labour demand is what we have observed over the past few quarters in the IFSD’s recently launched is Canada JØLTS analysis (Chart 2). Specifically, despite a modest reprieve from its post-recession peak, reached in July 2017, outflows from unemployment have surged in recent quarters, suggesting persistent demand by employers. This point was further reinforced in the Bank of Canada’s Autumn 2017 Business Outlook Survey, which has shown a continued trend in elevated expectations for future hiring and increasingly intense labour shortages (Chart 3).

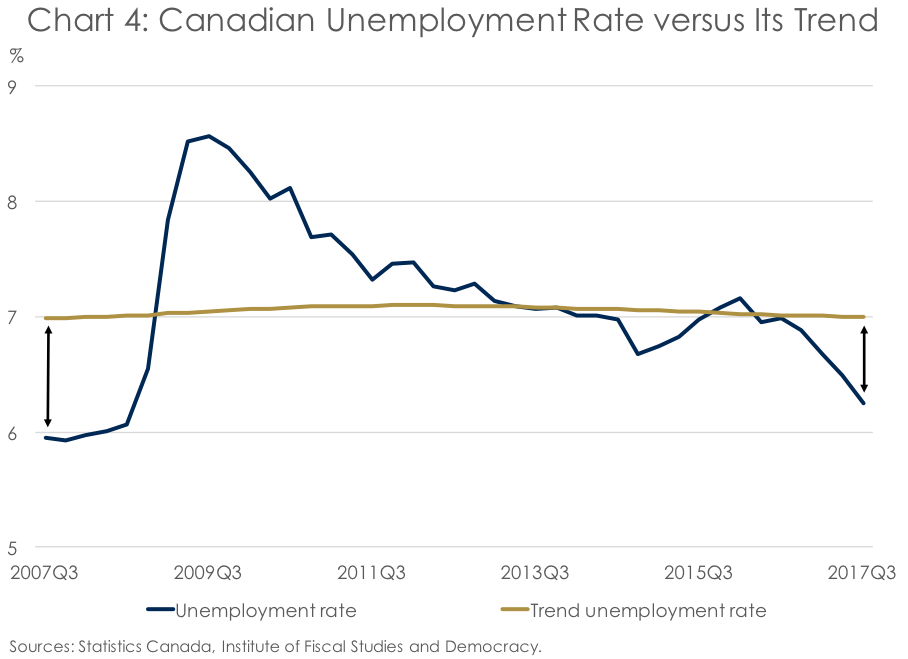

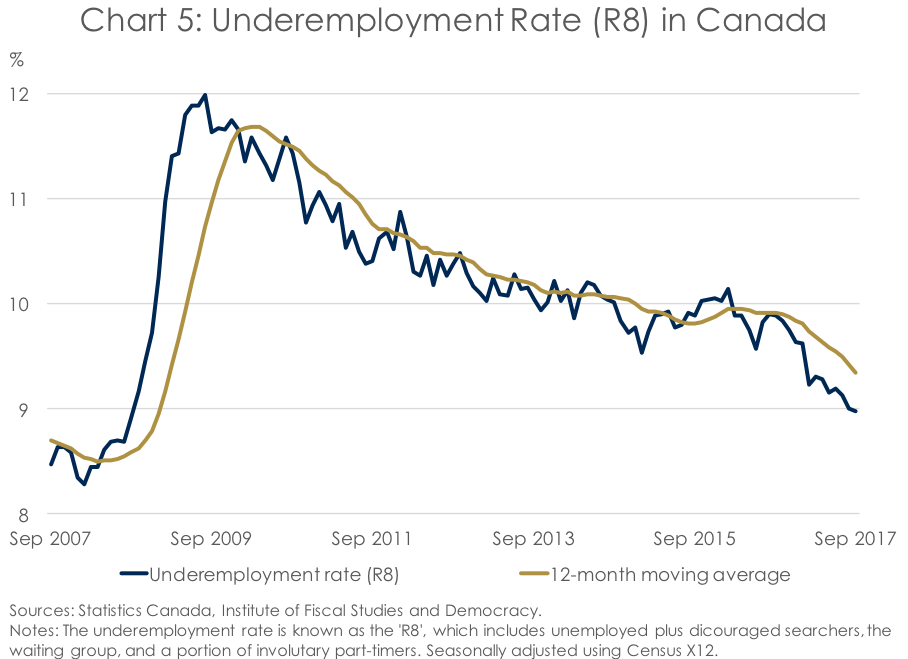

As a result of the acceleration in unemployment outflows relative to inflows, by the IFSD’s estimate, not only has actual real GDP outperformed potential GDP, but the level of the unemployment rate is also greatly improved relative to its trend measure (Chart 4). Additionally, the quality of jobs in Canada has also improved. Hence the sharp reduction in underemployment, which has fallen to its lowest level since the 2008-09 recession and has almost reached its historic, pre-recession low (Chart 5).

Outlook for accelerating wage growth and inflation in Canada

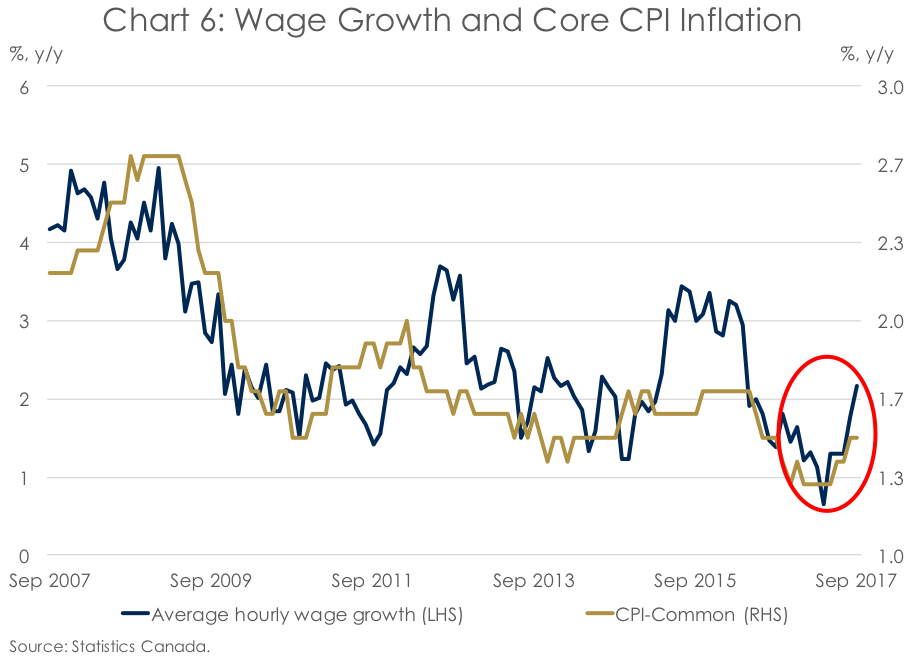

So, if the economy is operating at or above its potential, the unemployment rate is below its trend, outflows from unemployment have spiked, underemployment is approaching record lows, and employers are optimistic about hiring in the coming months, what could this mean for wages? The answer is that they can clearly be expected to move higher. And, while wage growth in Canada advanced at a snail’s pace from mid-2016 to early-2017, it has accelerated over the past six months or so, and core CPI inflation along with it (Chart 6). Meanwhile, higher and rising minimum wages in Alberta and Ontario through January 2019will further contribute to this phenomenon over the next couple of years.

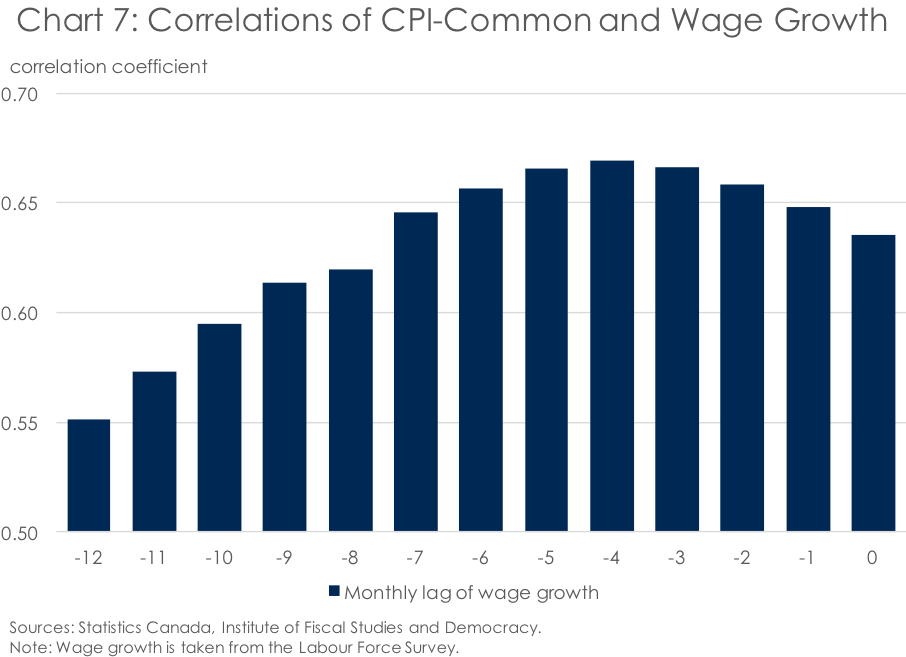

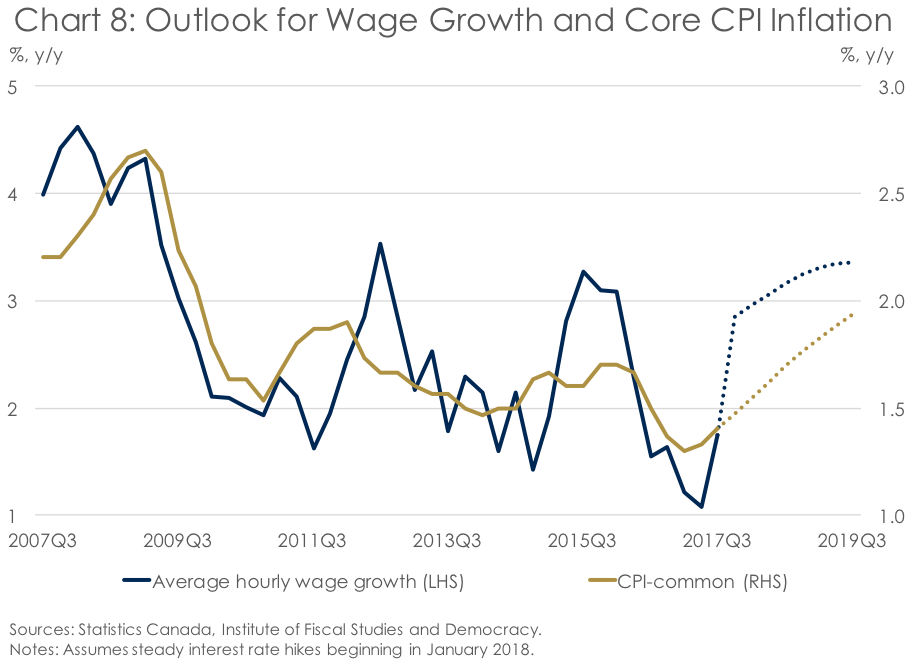

In working to understand the state of underlying CPI inflation, the Bank of Canada looks to three core measures: CPI-trim, CPI-median, and CPI-common. Of these measures, the one that seems to have garnered the most attention in Bank of Canada communications, and also happens to be the most highly correlated with the Bank of Canada’s (and IFSD’s) output gap, is the CPI-common. But, not only is CPI-common the measure of core CPI inflation that is most highly correlated with the output gap, it is also the most highly correlated with wage growth (Chart 7). So, what does this tell us? It tells us that core CPI inflation is about to move higher thanks to both accelerating wage gains, as well as an economy that is operating above its potential (Chart 8). And given core CPI inflation explains the lion’s share of the movement in total CPI inflation – the Bank of Canada’s actual target for monetary policy – by its nature, it too can be expected to accelerate.

What the current state of the Canadian economy suggests for monetary policy

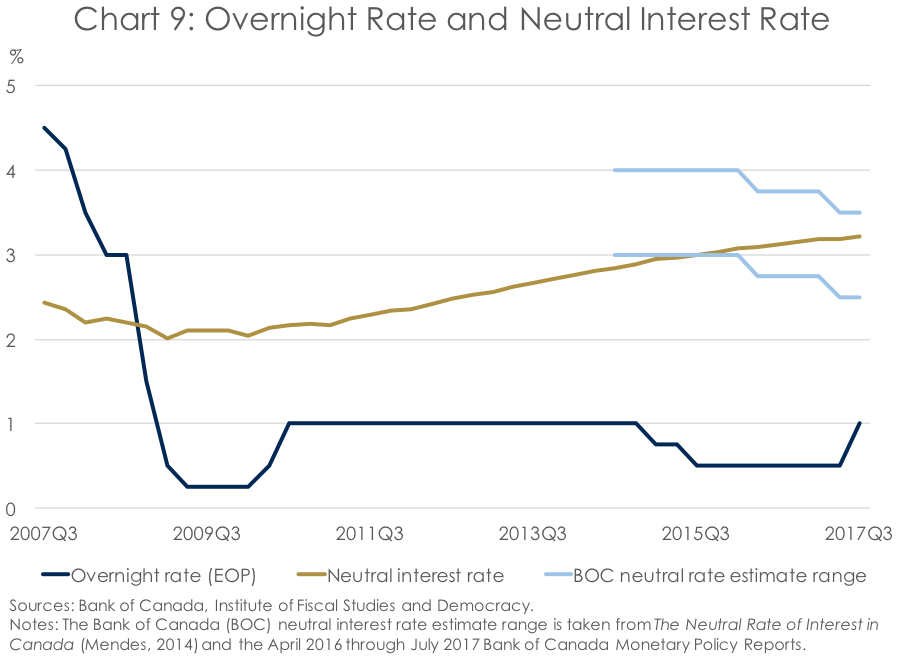

With the output gap currently closed or in positive territory, wage growth accelerating, and core CPI inflation edging toward the Bank of Canada’s 2% target, economic theory suggests that the overnight interest rate – the Bank of Canada’s monetary policy rate – should be approaching its ‘neutral rate’. The neutral interest rate is the level that the overnight rate would be roughly at if the economy is back at its potential and inflation is back at its 2% target. And given the Bank of Canada is forward looking in how it conducts monetary policy, meaning it takes into account impact of interest rates today on inflation in the future, all of the economic indicators suggest that the Bank of Canada should be working to close any gap between the overnight rate and the neutral interest rate.

Indeed, this is what happened recently as a result of interest rate hikes in both July and September 2017. But, while changes in the level of interest rates are important, what really matters in terms of the degree of monetary policy accommodation is where the level of the overnight rate is relative to the neutral rate. And, according to Bank of Canada and IFSD estimates, the overnight interest rate remains well below the neutral interest rate (Chart 9). As a result, monetary policy in Canada cannot be considered anything other than highly accommodative currently.

However, as the Bank of Canada’s Governing Council has made clear in recent speeches (at least as clear as a central bankers reasonably can), another rate hike is off the table at the upcoming October 2017 interest rate announcement, and maybe beyond. In order to justify this decision, Bank of Canada communications have been working overtime to reinforce the point that the Governing Council believes the Canadian economy is more productive than they had originally thought. Consequently, the Governing Council seems of the view that the level of potential GDP is likely higher than previously estimated, meaning current economic activity is further away from its potential than was estimated in July 2017.

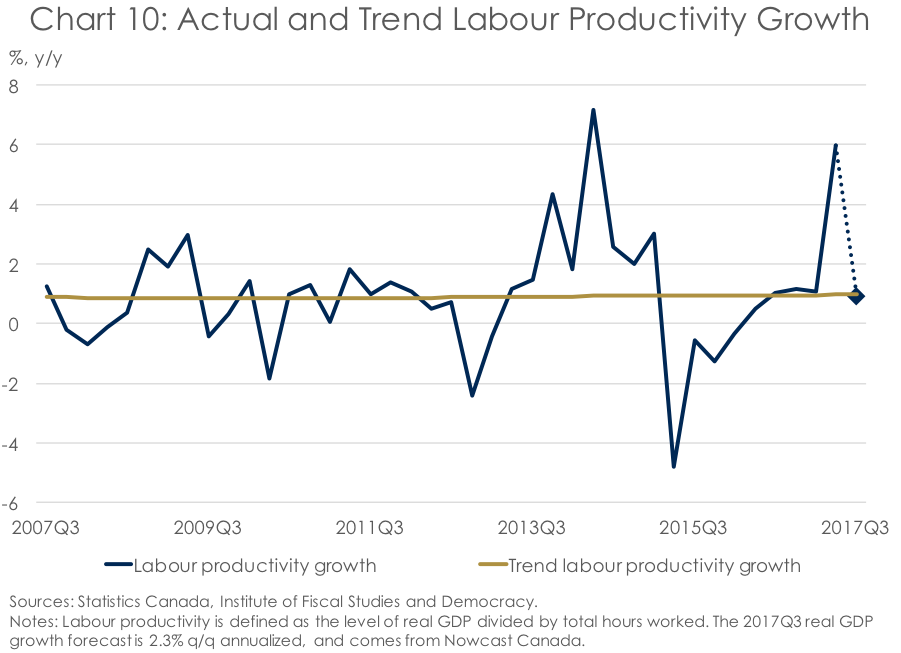

But, there is real concern that the Bank of Canada may be ‘jumping the gun’ in reaching these conclusions, as firm creation slowed in the second quarter and productivity growth is on track to return to trend in 2017Q3 (Chart 10). So why does the Bank seem so gung-ho about adjusting potential GDP – an unobservable variable – higher in order to justify keeping interest rates on hold in October 2017? The answer appears to be that the Bank of Canada wants to avoid the realization of any financial system risks associated with highly-leveraged households that would result from raising interest rates quickly, even if keeping rates near historically low levels is out of step with signals coming from the economic data.

Conclusion

Unfortunately, this approach to conducting monetary policy – adjusting unobservable variables to justify pre-determined policies – means that the Bank of Canada is really just ‘kicking the can down the road’. Keeping interest rates artificially low for long when it is not warranted by the data is just pouring gas on Canada’s economic fire, thereby exacerbating the future financial system risks that the Bank of Canada is trying to avoid today. Indeed, ultra-low interest rates are what got us into the current household-indebtedness mess we’re in, and continued low interest rates are surely not going to get us out of it.