Mostafa Askari

Following the unprecedented increase in government spending to help Canadians cope with the impacts of COVID-19, concerns have been raised about the sharp increase in debt and deficit and the sustainability of government finances in the long run.

Before the 2019 election, Finance Canada published long-term (until 2055) economic and fiscal projections that assessed government’s long-term fiscal sustainability. Since the 2019 election the government has only provided 5-year economic and fiscal projections in FES 2019 and FES 2020. The long-term projection has not been updated to show the implications of COVID-19. However, the Office of the Parliamentary Budget Officer (OPBO) has provided its annual fiscal sustainability reports and updated the 2020 report in November 2020 to show the impact of COVID-19 as of September 2020. [i]

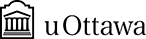

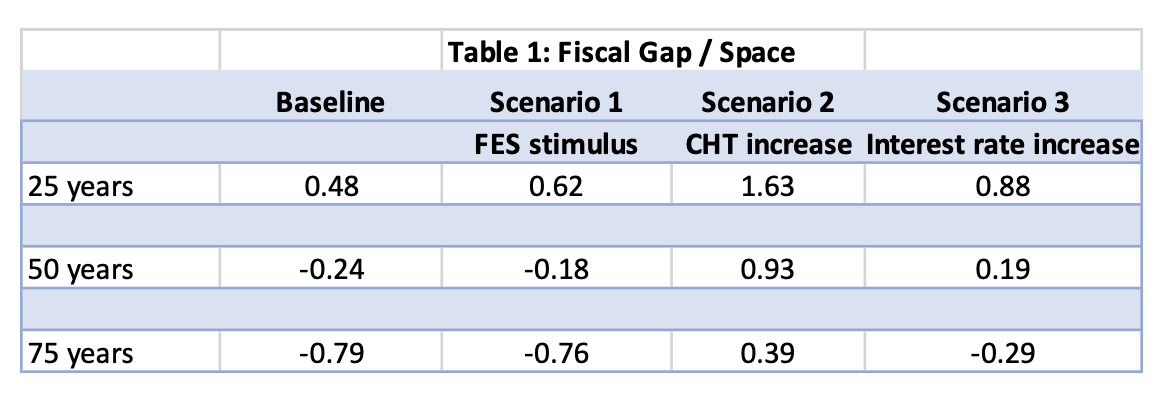

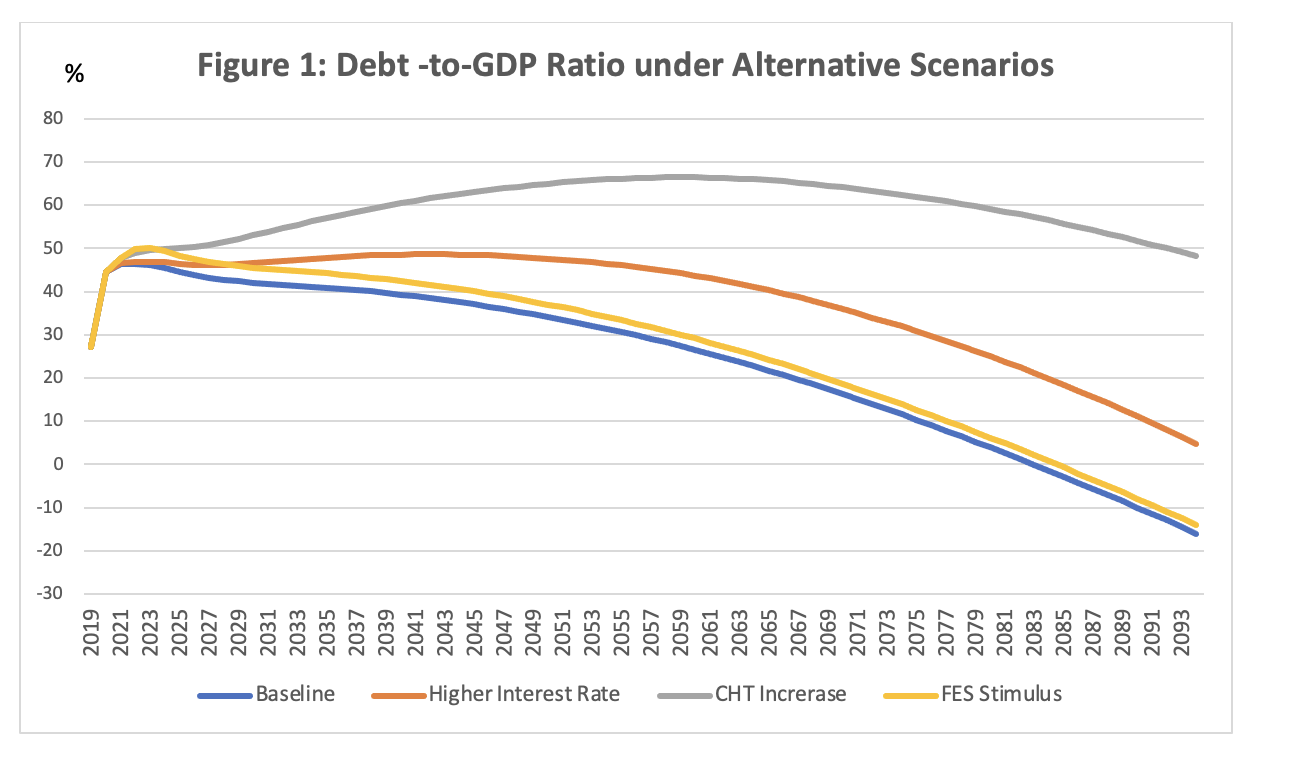

In this note we have updated OPBO’s estimates for the new COVID-19 related spending measures since September 2020. This baseline estimate shows that over a 25-year horizon there is a fiscal gap of 0.48 per cent. This means that the debt-to-GDP ratio does not return to its 2019 level and that the current fiscal structure is not sustainable over the 25-year horizon. However, over a longer-term horizon, which is more appropriate for assessing long-term fiscal sustainability, the current fiscal situation is sustainable and there is fiscal room (-0.24 and -0.79 per cent over the 50-year and 75-year horizons respectively).

The baseline scenario confirms that even with the COVID-related deep recession and the sharp increase in government spending Canada’s current federal finances (assuming no new programs are introduced) continue to be sustainable in the long run, although the fiscal room is smaller than estimated before the COVID-19 shock. There are, however, risks that may change this assessment.

We examine three alternative scenarios:

Scenario 1: In the Fall Economic Statement (FES) the government announced that it might introduce fiscal stimulus measures of up to $100 billion over the period 2021-22 to 2023-24. This is a temporary increase in spending that will not affect the level of government spending beyond 2023-24. Scenario 1 assesses the impact of the fiscal stimulus on long-term fiscal sustainability.

Scenario 2: We assume that the government will respond positively to the recent provinces’ request for increasing the CHT by $28 billion in 2021 and allow that to grow with the CHT escalator beyond 2021.

Scenario 3: We examine the impact of a rise in the effective interest rate. The interest rate is raised by 25 basis points every year from 2021 until 2024 and then stays 100 basis points above the baseline level for the rest of the projection period.

Key results (Table 1, Figures 1 and 2):

- The proposed FES fiscal stimulus would have little impact on the measure of fiscal room and long-term fiscal sustainability. It would increase the debt-to-GDP ratio in the short run but does not have any significant impact on its long-term level and profile. The reason for this result is that the stimulus represents a temporary increase in spending with only short-term impacts on the primary deficit and little impact on the debt in the long run.

- The increase in CHT, which is a permanent increase in government spending, makes the fiscal situation unsustainable in the long run. While the debt-to-GDP ratio would begin to fall in 2066 as the primary deficit reaches closer to zero, it would remain well above its 2019 level after 75 years.

- The increase in interest rates brings the effective rate closer to the forecasted growth in GDP. This together with the deterioration in the primary balance in the baseline leads to a rise in the debt-to-GDP ratio in the short run. The result is a substantial increase in the fiscal gap in the short run and a marked decline in the fiscal room over a 75-year horizon.

The key message from this exercise is that while the current fiscal structure is sustainable in the long run, it is vulnerable to interest rate shocks and significant permanent increases in government spending. Risks related to higher inflation and interest rates should not be under played. New structural policy programs should be financed with higher revenues (or spending reallocations) to maintain long-term fiscal sustainability. Higher COVID and post-COVID debt should come with clear fiscal anchors, guard rails and rules.