The Last Page

Dilico Anishinabek Family Care: collecting and applying strengths-based data on health, mental health, and child and family services

This analysis was produced by IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis do not necessarily reflect the views of the AFN.

"Are these kids just a figment of their imagination?” A case study on Animikii Ozoson Child & Family Services

This analysis was produced by IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis do not necessarily reflect the views of the AFN.

Challenges of Implementation and Major Policy Change: Indigenous Affairs in Australia

This analysis was produced at the request of IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis of the independent authors do not necessarily reflect the views of the AFN or IFSD.

Why Measuring Matters

This research was produced at the request of IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis of the independent authors do not necessarily reflect the views of the AFN or IFSD.

Intergenerational Trauma To Intergenerational Transmission

This first person narrative was produced at the request of IFSD to support ongoing research in First Nations child and family services. IFSD's work is undertaken through a contract with the Assembly of First Nations (AFN). The views and analysis of the independent authors do not necessarily reflect the views of the AFN or IFSD.

Consumer price inflation and funding for First Nations

This note briefly describes what inflation is and how it is measured. It discusses the recent sharp increases in inflation in Canada, which has brought hardship to many Canadians, particularly First Nations.

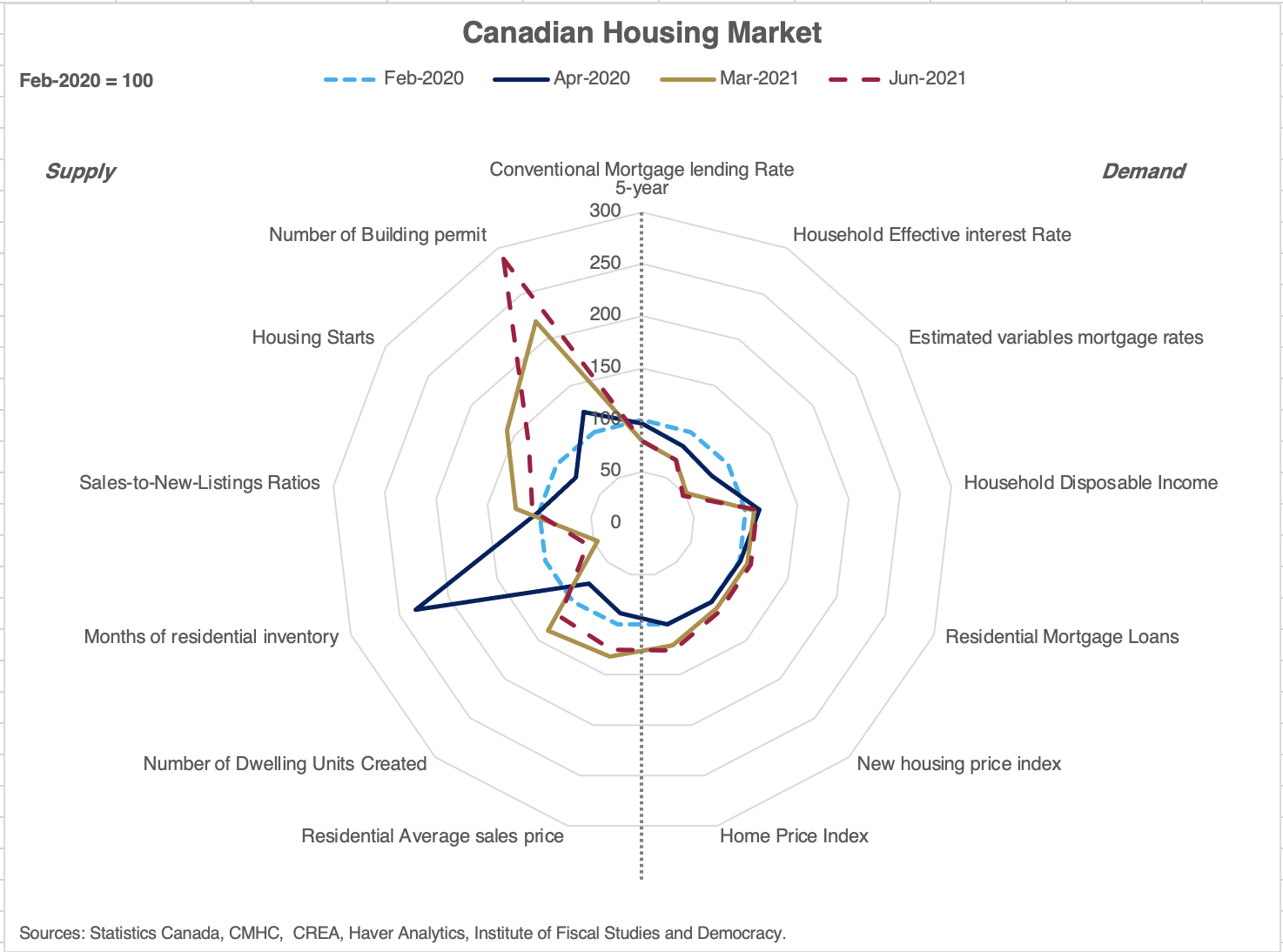

Canadian Housing Market Challenged by Pandemic Jolts: A year-long indicator analysis

Assessing how the Canadian dream of homeownership was affected through this challenging period can provide helpful context for understanding the impacts on this industry and help guide new policies to calm the market. In this note, we selected a number of metrics for both supply and demand in the housing market.

Testing platforms through fiscal credibility: A summary of the 2021 platforms of the Liberal Party of Canada (LPC), Conservative Party of Canada (CPC), and New Democratic Party (NDP)

Using the framework, the platforms of the Liberal Party of Canada (LPC), the Conservative Party of Canada (CPC), and the New Democratic Party (NDP) were assessed ahead of Election Day 2021. IFSD assessed the parties’ platforms in the order in which they were released and published its findings (LPC, CPC, NDP

IFSD Fiscal Credibility Assessment New Democratic Party Platform 2021

IFSD finds that the New Democratic Party (NDP) Platform 2021 merits a rating of ‘pass,’ with ratings of ‘good’ for realistic economic and fiscal assumptions, a ‘pass’ for responsible fiscal management, and a’ fail’ on transparency.

IFSD Fiscal Credibility Assessment Conservative Party of Canada Platform 2021

IFSD finds The Conservative Party of Canada’s Platform with ratings of ‘good’ across two of the three assessment principles (realistic economic and fiscal assumptions, responsible fiscal management, and transparency).